Be Sure Your Illinois Lawyer Carries Malpractice Insurance

A few years ago, the Chief Counsel of the Illinois Attorney Registration and Discipline Commission (ARDC) released surprising and concerning data: 41 percent of solo practitioners in Illinois do not carry malpractice insurance. Of 13,500 solo attorneys in the state, 5,500 practice without malpractice insurance. Nine percent of small firms do not maintain malpractice insurance. Overall, the ARDC reports that 87% of Illinois lawyers carry malpractice insurance.

People come to attorneys with serious problems, and mistakes can be costly. Even the very best attorneys are human and can make mistakes. Lawyers owe it to their clients to carry malpractice insurance, and clients owe it to themselves to make sure their lawyer has malpractice coverage. Fortunately, Illinois lawyers must report whether they carry malpractice insurance to the ARDC. If you are considering hiring a lawyer, first look the lawyer up on the ARDC’s website and make sure they have malpractice coverage. This search will also tell if you the lawyer has been disciplined by the bar for ethical reasons.

Most folks would be surprised to learn that more than 40 percent of solo practitioners in Illinois do not carry malpractice insurance. I think lawyers should be required to carry malpractice insurance, much like drivers are required to carry minimum liability insurance. If nothing else, lawyers who do not carry malpractice insurance should have to disclose their lack of coverage to every client in a written engagement agreement. Until this time comes, at minimum clients should ask their lawyers if they have malpractice coverage, or better yet “trust but verify.” Again, the ARDC’s Lawyer Search feature allows you to find out for yourself.

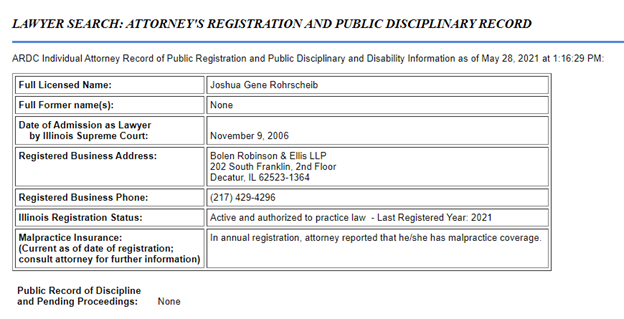

For example, here’s a screenshot of what you’ll find if you look me up:

It is possible some lawyers who do not carry malpractice insurance coverage have a reasonable justification for this decision. Perhaps they are nearing retirement and not actively practicing but maintaining a license. Perhaps they believe they have very low risk, are very careful, and they have sufficient personal wealth to self-insure. Or perhaps they practice in an area where malpractice claims are very uncommon. However, for each of the above cases, there may also be a lawyer who is judgment proof and would simply file bankruptcy if he had a malpractice claim, or a lawyer who didn’t want to pick up malpractice coverage because they need to keep costs down, or a lawyer who stopped carrying malpractice coverage because premiums increased after previous malpractice claims. If you find your lawyer does not carry malpractice coverage, but you really like the lawyer, it seems reasonable to me for the client to ask the lawyer about their decision not to carry malpractice coverage, and what risks that could create for the client.

That said, the wisest course seems to be working with lawyers who have malpractice coverage. It seems reasonable to suspect those lawyers who do not carry malpractice insurance are perhaps more likely to also have gaps in judgment that could lead to malpractice claims.

Malpractice insurance for solo practitioners is relatively inexpensive. When I left the solo practice in 2015, the cost of my malpractice coverage was under $1,500 per year. This was probably a little lower than average, as I was a relatively new lawyer taking advantage of discounts for younger lawyers, but for most practice areas coverage for a solo is likely to be $3,000 or less. When you consider the protection malpractice insurance coverage provides for both the lawyer and for the client, it seems like an especially good value to purchase coverage, and a true disservice to the client, at least in most circumstances, to practice law without malpractice coverage.